巴比特专栏 | 数字英镑:金融科技故事里的愿景与初心

央行的数字法币是近期我国最受关注的金融科技重大事件之一。我们从不太远的2016年的一份金融科技的演讲中寻觅最初数字法币的愿景。2019年8月底,英国央行的马克卡尼在美国演讲公开反对美元霸权,并对美元为世界储备货币持反对态度,提出可能出现一种综合霸权数字货币来取代美元。英格兰银行作为现代银行业的鼻祖,在Libra发布白皮书后,对数字货币的这一表态令各国感到震撼,各国央行和主要金融机构对数字货币的关注度进一步加深。其后,26国央行对Libra进行了听证,德法两国财长在会后联合表态,对Libra明确持反对态度。

2019年9月底,笔者自英国回来之后,在与Fnality公司讨论以及悉心研究Fnality的USC稳定币批发型数字法币项目的过程中,梳理和回顾了作为英国央行的英格兰银行在数字货币研究中的相关文献。我们发现,作为数字法币研究第一梯队的领军者,英国央行早在2015年提出的数字英镑计划,远比想象中高瞻远瞩,研究团队据此撰写了《隐藏复兴百年英镑的大计划-揭开英国央行数字法币之谜》一文。

在追踪英国数字法币研究的思路过程中,2016年9月由英国央行的首席出纳员Victoria Cleland 在伦敦所做的演讲对笔者影响很大。研究团队将其译成中文,对于研究数字法币的学者,也能够知道数字法币的发展历史。

译文中所展现的内容是公开渠道下载而来。这份演讲中主要传递的观点包括:

1)科技改变商业和金融。并对这一观点进行了实例阐释。其中特别提到重视科技,也就是数字科技或是金融科技(Fintech)。目前而言,国内的部分观点认为科技不能改变商业和金融的本质,认为科技服务商业和金融业,但不能改变他们,比如要求区块链技术绕开金融发展。N•格里高利•曼昆 (N. Gregory Mankiw)在著名教科书《宏观经济学》说“宏观经济学是一门经验学科,由广泛的经验推动和指导”又说“当经济形势发生变化的时,经济学者总是及时更新课堂内容”。2019年在脸书Libra出来后,世界金融界因为震撼而纷纷采取对应的行动代表经济形势已经变化。如果认为科技改变金融,这发展空间就非常大,新技术带来的改变将改写现有的经济学和管理学理论框架。

2)数字法币是322年来的首次货币大变革。这一观点的抛出,是基于英镑这一老牌货币的历史沿革,而英国央行成立于1694年,正好离2016年322年。保守谨慎的英国对货币政策的坚守决不会低于新兴国家,但当技术应用走到历史的路口,英国是首先应对和提出对策的。因此,当时在场的央行学者都为之兴奋不已,意识到一个新的时代的来临。她在这篇演讲中强调,英国央行在过去322年没有改变过英镑,这是历史上第一次。由此可见,英格兰银行对数字法币的发行和研究是经过深思熟虑的。

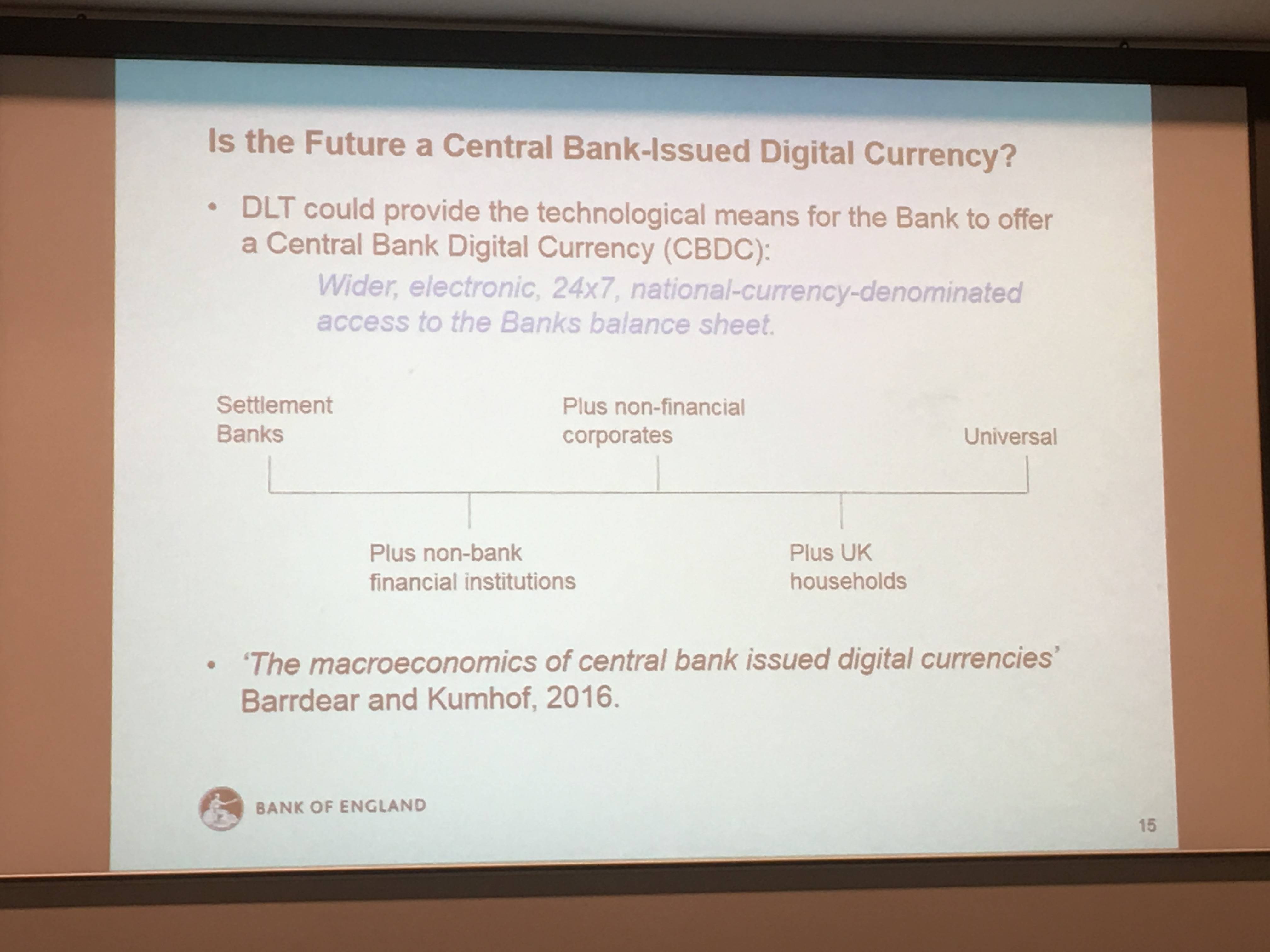

3)数字英镑的运行方式。数字英镑将会和比特币等数字代币一样,一年365天一天24小时交易,但是背后的交易支持是由央行提供的。数字英镑是法币,这一核心理念是英格兰银行自始至终保持的,运行方式将和所有的法币系统一样,是央行主导和监管的。在信息技术的支持下,交易不间断,数字化特征与现有的数字货币无差别,但应用更加安全和方便。

4)数字英镑的大央行主义。货币是经济社会资金融通和商品流转的核心工具,因此数字英镑的大央行主义强调其服务群体是与原有的信用货币体系完全相同,甚至更加广泛。作为法定货币,数字英镑为商业银行、商业企业和普遍人群提供服务。履行货币作为交易媒介、价值尺度、流通手段和财富储存的功能。且大央行在监管中,将为交易安全提供更加便利的技术手段和信息化平台。

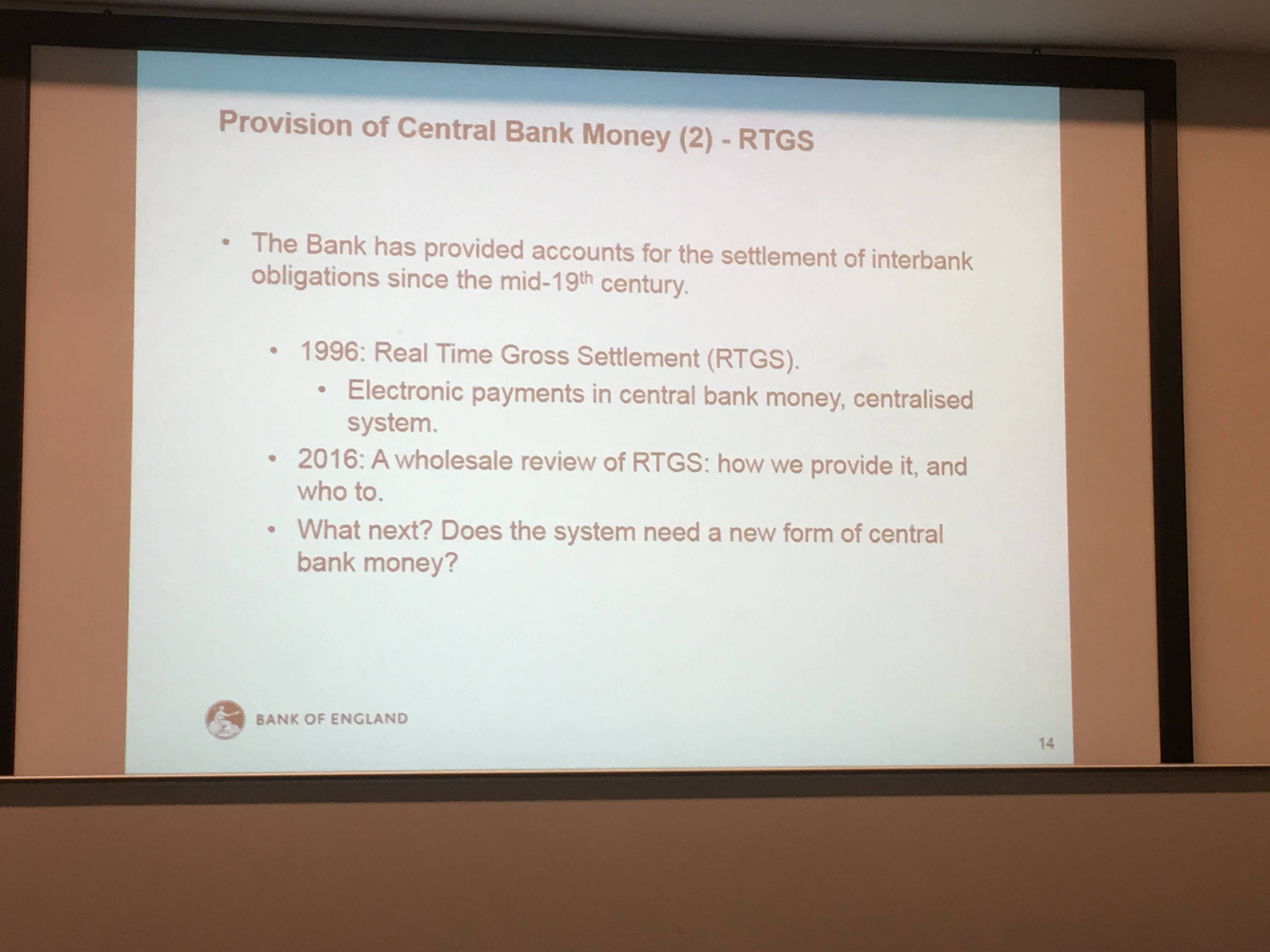

5)开放RTGS实时全额支付系统。RTGS(Real Time Gross Settlement)是按照国际标准建立的跨银行电子转帐系统。RTGS模式中结算是实时完成,该模式对银行的流动性要求较高,适合于单笔金额大而交易笔数少的支付系统,我国的大额支付系统和美国的Fedwire系统采用这一模式。英国央行为了建立这样的数字法币,决定研究开放RTGS给英国的科技公司,以支持央行的数字法币。探讨为科技公司在金融创新领域开放支付通道,其支持力度可见一斑。

6)数字法币的推出必然改变现有金融体系。在演讲发表时,甚至时至今日,一些学者坚持认为数字法币只是一个科技项目,没有其他任何意义。脸书的Libra白皮书发布后,仍有经济学者认为Libra或者其他数字货币丝毫没有改变金融体系。在对Fnality白皮书的研读之后,我们更加坚信,数字法币的发行一定会对现有金融体系带来巨大改变。在这个发表于英国央行的演说中,认为银行将可能失去中介地位,这显然极大冲击了现有的金融体系。

7)央行发行数字法币会引发银行与商业银行的竞争存款。数字英镑让央行能够更加便利的直接服务于企业、个人和商业银行,因此对于英格兰银行这样本身集合中央银行和商业银行功能于一体的机制来说,这种便利性带来央行能力的提升将更加明显。在平常的时候,老百姓吧钱放在那里没有很大差别,但是一旦有经济危机,老百姓就会讲从商业银行存款转到央行数字法币上,因为那是零风险,这将挤占商业银行的存款。在经济危机的时候,央行不希望资金留在央行里面,而是使用资金来保护实体。另外商业银行的低效模式将造成经营份额被挤压。在2018年7月出现合成数字法币(sCBDC)后,发行稳定币的科技公司也和商业银行竞争,这问题国际货币基金组织在2019年7月出的报告《数字货币兴起》讨论。我们也出《十面埋伏,商业银行真的会四面楚歌?》来分析。

8)预测批发数字法币(wCBDC)和零售数字法币(rCBDC)2种不同数字法币模型的的出现。

虽然我们力图讲解讲演的主要观点和现场的热点问题,但深知讲解得再美好,也不可复制现场交流中的火花触碰,为了帮助读者理解,将演讲的PPT附后,希望大家能够从中体会英国央行数字法币研发的初心、布局以及后来计划的实施历程。

这演讲稿是事后改写的,当时在现场她还分享了2个重要观点没有在稿子出现: 一是英国央行对第3方支付非常担忧并且出示数据,二是认为数字英镑的愿景是回到以前英镑是世界储备货币的时代。第2个观点她轻轻带过,没有解释。在场的大多数的人都不在意因为认为这是不可能的任务。后来发现,英国央行事实上对这2项都非常在意。在2019年8月英国央行行长在美国本土公开反对美元霸权就是一个明证。

Fintech: opportunities for all?

金融科技:所有人的机会?

Remarks given by Victora Cleland, Chief Cashier

Victoria Cleland, Chief Cashier的致辞

It is a pleasure to be here, at the second international workshop for P2P Financial Systems: an event focused on the exciting changes that technology is making to the world of finance, and in particular digital currencies and distributed ledger technology, crowdfunding and peer-to-peer lending. 很高兴来到这里,参加第二届P2P金融系统国际研讨会:专注研讨科技正在给金融界带来巨大变化的事件,特别是数字货币和分布式账本技术、众筹和点对点贷款。The Bank is proud to co-sponsor this valuable opportunity to bring together a diverse range of experts – academics, technology innovators, financial institutions, policy makers, and regulators – to share knowledge, make new connections, and sow the seeds for future collaboration. 本行(译者:英国央行)很荣幸能够共同赞助这次宝贵的机会,汇集各种专家,包括学者、技术创新者、金融机构、政策制定者和监管者,分享知识,建立新的联系并为未来的合作播下种子。

The Bank of England has long been committed to, and benefitted from, collaboration. Last year alone we launched the One Bank Research Agenda and held a stimulating Open Forum. We are currently engaging with a wide range of stakeholders on a number of key policy areas of importance to the Bank’s future work, from digital currencies to climate change. 英格兰银行(译者:英国央行)长期以来一直致力于合作并从中受益。仅去年一年,我们就启动了“一个银行研究计划”,并举办了一次激动人心的开放论坛。从数字货币到气候变化,我们目前正在与众多利益相关者合作,探讨对银行未来工作至关重要的许多关键政策领域。

The benefits of working together across sectors and employing genuine diversity of thought are not new and were acknowledged by John Stuart Mill almost 170 years ago: ‘It is hardly possible to overrate the value…of placing human beings in contact with persons dissimilar to themselves, and with modes of thought and action unlike those with which they are familiar…such communication has always been…one of the primary sources of progress.’ 跨部门合作和采用真正的思想多样性所带来的好处并不是什么新鲜事,并且在大约170年前就被约翰·斯图尔特·米尔(John Stuart Mill)所承认:“几乎不可能高估……将人与不同思想的人交往的价值,以及与他们所熟悉的思维方式和行动方式不同……这种交流一直是……进步的主要来源之一。”

For this reason central banks across the world, many of which are present here today, have historically worked together with universities. We continue to develop and benefit from these relationships and we seek to learn from the private sector and from innovators. 因此,世界各地的中央银行历来都与大学合作,而当今世界上有许多中央银行。我们将继续发展并从这些关系中受益,我们寻求向私营部门和创新者学习。

Technology has never been more important to our day-to-day lives. We rely on it to keep us informed about the news, for shopping, for finding our way around, and even, I understand, for finding romance. Technology has also had a huge impact on commerce.

技术对我们的日常生活从未如此重要。我们依靠它来使我们随时了解新闻,购物,找到自己的出路,甚至据我所知找到爱情。技术也对商业产生了巨大的影响。

The past decade or so has witnessed the emergence of new business models that utilise technology to offer goods and services in different ways. We now have many new household names – Uber, Netflix, Airbnb, I could go on. Firms like these have recalibrated the demands of consumers, who increasingly expect goods and services to be provided more quickly, cheaply, and effortlessly - often by using of smartphones. Some businesses have emerged, some have prospered, but others have failed to adapt, resulting in the disappearance of some once famous names from the high street. 在过去的大约十年中,见证了新的商业模式的出现,这些商业模式利用技术以不同的方式提供商品和服务。现在,我们有了许多新的家喻户晓的名字Uber,Netflix,Airbnb,等等。像这样的公司已经重新调整了消费者的需求,他们越来越希望通过使用智能手机来更快、更便宜、更轻松地提供商品和服务。在这个过程中,一些企业兴起,一些企业兴旺,但另一些却未能适应,导致一些曾经名声大噪的企业名字从街头消失。

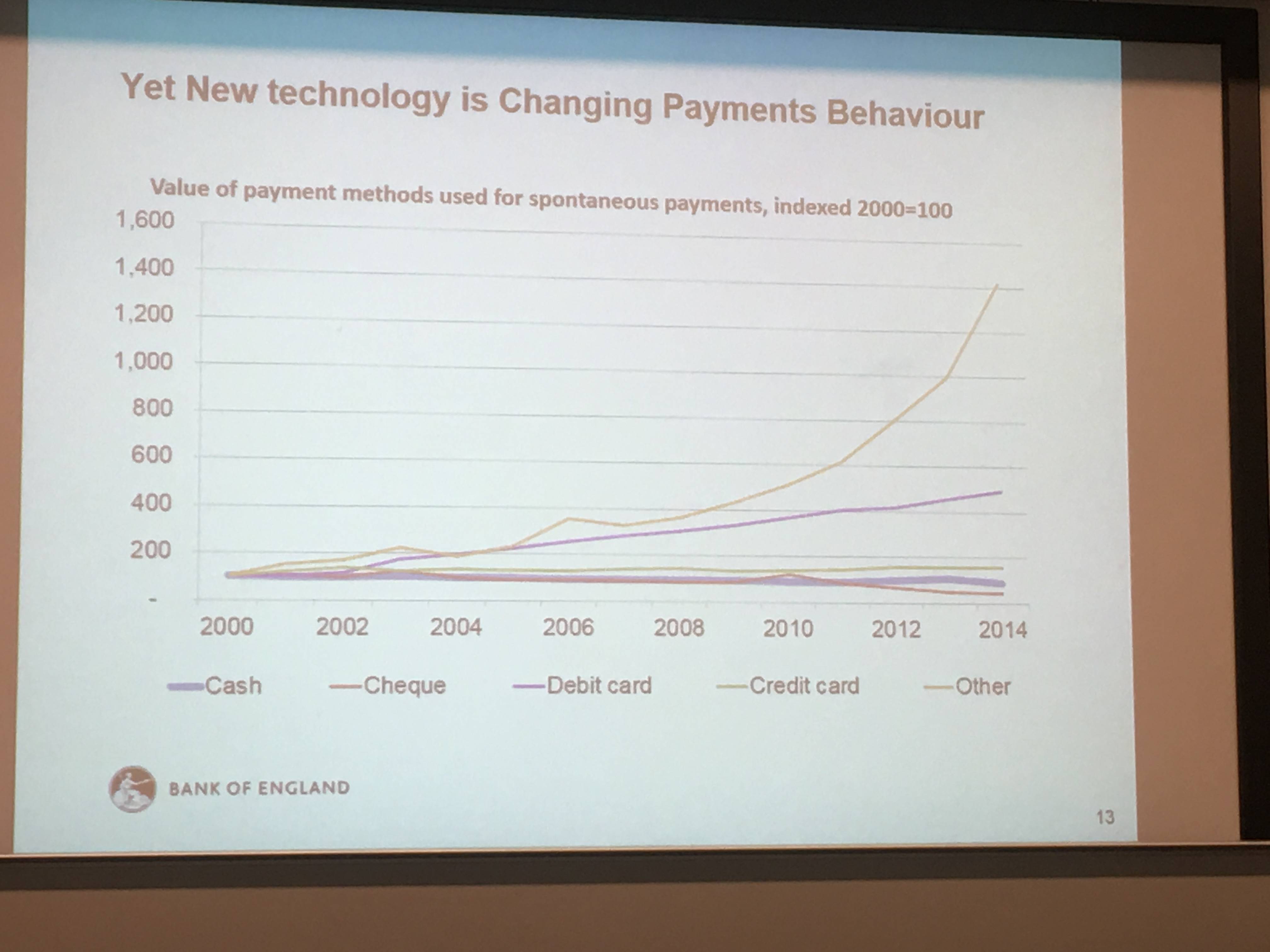

And technology is also changing the financial system: a sector that is perhaps more susceptible than most to transformation, given its products are already almost entirely digital. Finance is also a sector where there is scope to do more to meet the growing demands of consumers. 技术也在改变金融体系:鉴于其产品已经几乎完全是数字化的,因此这个行业可能比大多数行业更容易转型。金融也是一个可以做更多的事情来满足消费者不断增长的需求的行业。

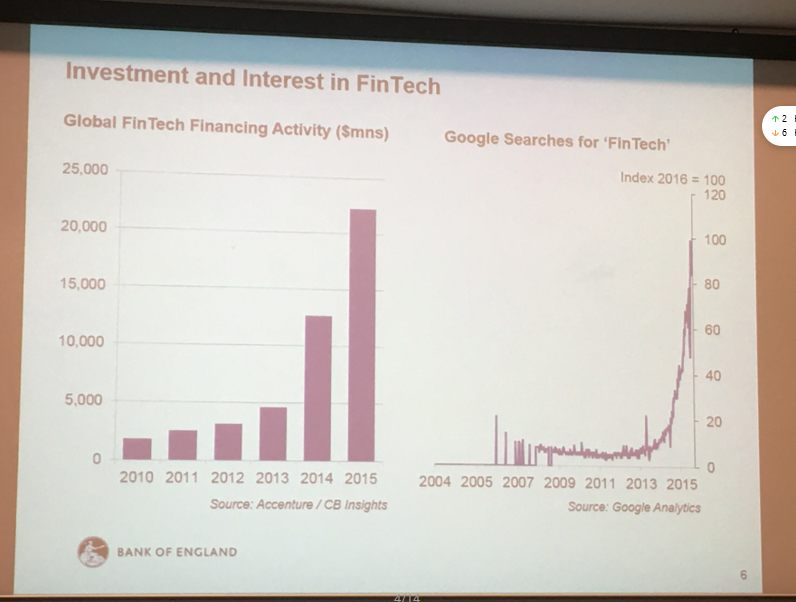

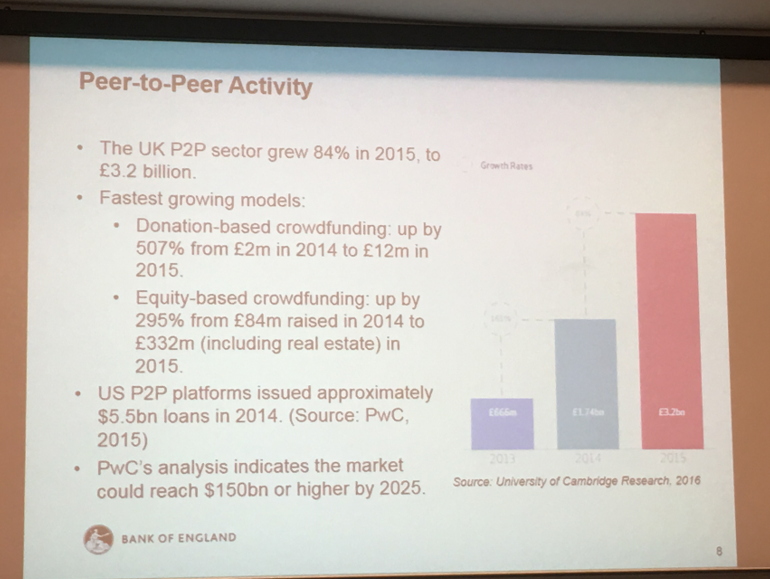

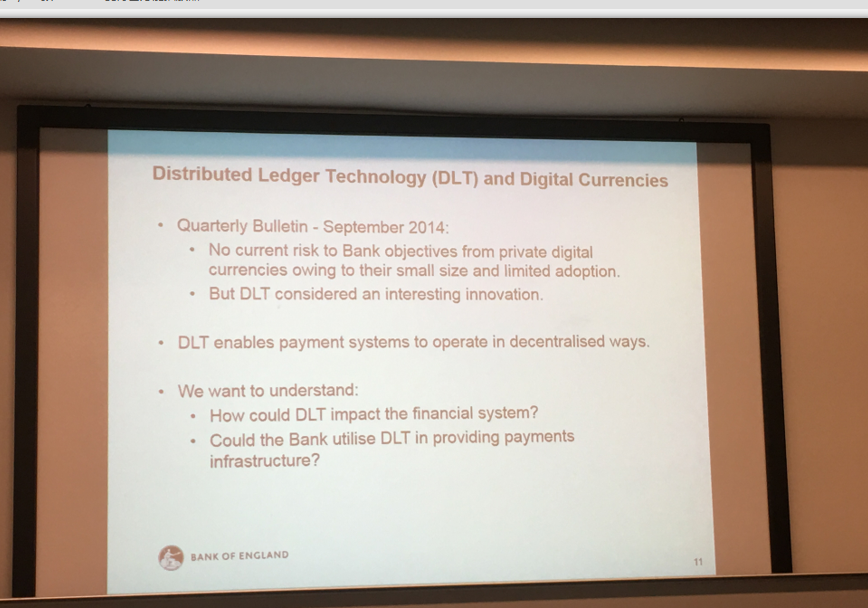

There is a lot of interest in Financial Technology – FinTech. The very nature of technological developments means that we can’t know how technology will be used in the future – could anyone in the 1980s have been able to predict what the internet is used for in 2016? There is a high expectation that the latest wave of FinTech activity will be transformative, with considerable activity expected not least around distributed ledger technology (DLT). Some of the most recent changes have been more tactical, and focused on enhancing the customer experience, while leaving the core structures unchanged. We have yet to see the paradigm shift. But there are projects underway that could reshape the trading and settlements landscape, and some have suggested that new crowdfunding and peer-to-peer deposit and lending schemes could disintermediate incumbent banks. 金融科技FinTech引起了很多兴趣。技术发展的本质是,我们不知道未来将如何使用技术,20世纪80年代的任何人都能预测2016年互联网的用途吗?人们对金融科技活动的最新浪潮将具有变革性抱有很高的期望,预计将有相当多的活动发生,尤其是围绕分布式账本技术(DLT)。最近的一些更改更具战略性,侧重于增强客户体验,同时保持核心结构不变。我们尚未看到范式的转变。但是,正在进行中的一些项目可能会重塑交易和结算的格局,并且有人建议,新的众筹以及点对点存款和借贷计划可能会使现有银行失去中间人的地位。

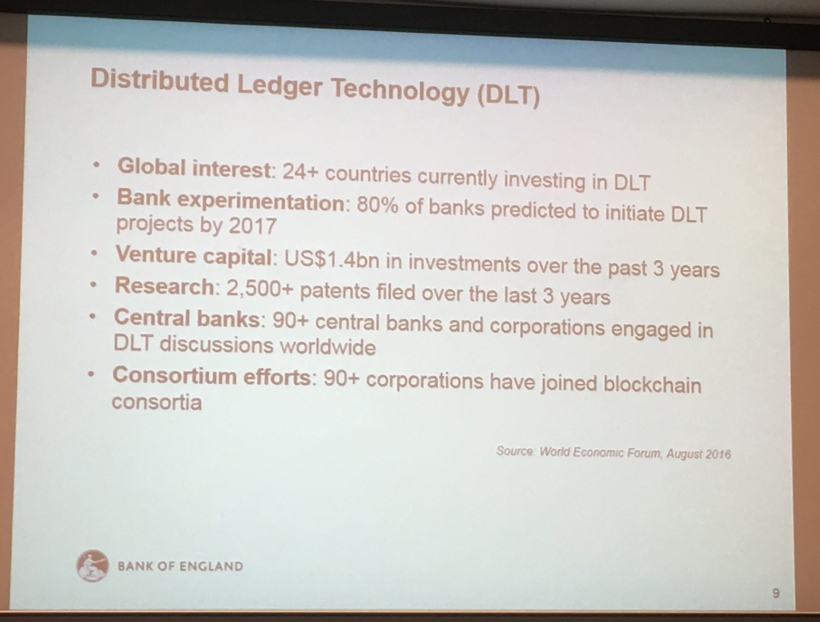

Since 2010, more than $50bn has been invested in almost 2,500 FinTech companies. In 2015 alone, the UK alternative finance sector grew by 84%. Over 24 countries are currently investing in DLT with $1.4bn in investments over the past three years. Over 90 central banks are engaged in DLT discussions worldwide and more than 90 corporations have joined blockchain consortia. 80% of banks are predicted to initiate DLT projects by 2017. 自2010年以来,已向近2500家金融科技公司投资了超过500亿美元。仅在2015年,英国的替代金融部门就增长了84%。过去24年中,有超过24个国家在投资DLT,过去三年的投资额为14亿美元。全球有90多家中央银行参与DLT讨论,已有90多家公司加入了区块链财团。预计到2017年,将有80%的银行启动DLT项目。

So, why is a 322 years old institution interested in FinTech? What are the opportunities for us? We are responsible for monetary and financial stability, for the macroprudential regulation of the many participants within the financial system, and for operating and promoting safe and efficient payment systems, including through the provision of the ultimate risk-free asset: central bank reserves and banknotes. We need to understand what FinTech means for the entities we regulate, how it might impact the overall safety and soundness of the financial system, and how it could alter the transmission mechanism for monetary policy. And of course for our own operations, through which we implement those policies. 那么,为什么一家拥有322年历史的机构(译者:指英国央行,成立于1694年,正好离开2016年322年)对FinTech感兴趣?对我们来说有什么机会?我们负责货币和金融稳定,负责金融体系内许多参与者的宏观审慎监管,并负责运营和促进安全高效的支付系统,包括提供最终的无风险资产:中央银行储备和纸币。我们需要了解金融科技对我们所监管实体的意义,如何影响金融体系的整体安全性和稳健性,以及如何改变金融政策的传导机制。当然,对于我们自己的运营,我们将通过这些运营来实施这些政策。

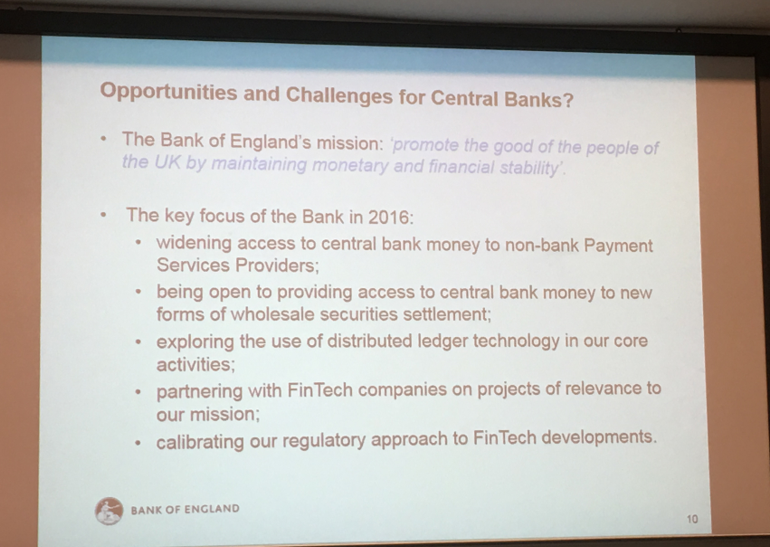

In his recent speech “Enabling the FinTech transformation: Revolution, Restoration, or Reformation?”.the Bank of England Governor Mark Carney, set out the ways the Bank is enabling the FinTech transformation:

widening access to central bank money to non-bank Payment Services Providers;

being open to providing access to central bank money to new forms of wholesale securities settlement;

exploring the use of DLT in our core activities;

partnering with FinTech companies on projects of relevance to our mission;

calibrating our regulatory approach to FinTech developments.

英格兰银行行长马克·卡尼(Mark Carney)在他最近的演讲“实现金融科技转型:是革命,恢复还是改革?”中阐明了该银行实现金融科技转型的方式:

•扩大央行业务,也提供非银行支付商可以在央行存款;

•开放向央行提供新形式的批发证券交易的结算;

•探索在我们(央行)的核心系统中使用DLT(分布式账本系统);

•与金融科技公司合作进行与央行相关的项目;

•调整我们对金融科技发展的监管方法(译者:在英国,监管单位隶属于央行)。

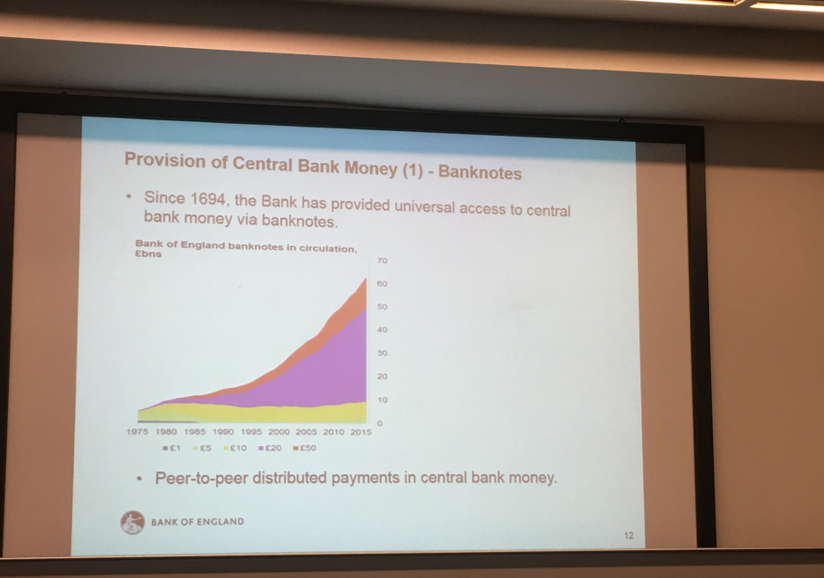

I would like to focus on 2 of these – widening access, and DLT. And before becoming too distracted with crystal ball gazing, I would briefly like to step back into the past - to 1694, when the Bank of England issued its first banknotes. Since then, the function of banknotes has remained broadly the same. A banknote is essentially an IOU from the central bank with a clear unit of account which enables the bearer to hold it as a store of value and use it as a medium of exchange.

我想重点介绍其中的两个:开放央行业务和DLT。在还没有被水晶球分散注意力之前(译者:水晶球是西方认为预测将来的仪器),我想简单地回顾一下过去,回到1694年,当时英格兰银行发行了第一批钞票。从那时起,纸币的功能大致保持不变。钞票本质上是中央银行的借条,具有清晰的帐户单位,使持票人能够将其保留为价值存储并用作交换媒介。

One could argue that, Bank of England notes were ahead of their time. They have always offered a very widely accepted, fully distributed, peer-to-peer payment mechanism. And banknotes provide full and final instantaneous settlement in central bank money. These banknotes are still a key payment method today and accounted for around half of consumer payments in 2015, with around 2.2mn UK citizens relying almost exclusively on cash for everyday transactions.And with demand expected to remain strong, it is important that banknotes too benefit from the state of the art technology. Indeed we look forward to launching our first polymer banknote – the £5 featuring Sir Winston Churchill, next week, on 13 September. 有人可能会说,英格兰银行的票据在以前就领先世界。他们一直提供了一种广泛接受的、完全分布式的点对点支付机制。钞票可以提供中央银行全部和最终的即时结算。这些钞票仍然是当今的主要付款方式,在2015年约占消费者付款的一半,约有220万英国公民几乎完全依靠现金进行日常交易,并且由于需求预计将保持强劲,因此重要的是,钞票也应从中受益,使用了最先进的技术。的确,我们期待着下周9月13日推出我们的第一张聚合物钞票--温斯顿·丘吉尔爵士的5英镑钞票。

Banknotes are not the only way that we enable settlement in central bank money. The Bank also provides commercial banks and a range of non-banks with access to central bank deposit accounts (usually referred to as ‘reserves’) and the ability to settle interbank obligations across these accounts, amounting to around £500 billion every day. Since we launched Real Time Gross Settlement (RTGS) infrastructure in 1996, settlement banks have benefitted from full and final instantaneous settlement. Now RTGS is twenty years old, the Bank is drawing up a blueprint for a new generation of RTGS. We will be consulting on a package of proposals very shortly, and have already committed to broadening access further to non-bank payment service providers. 钞票不是我们(央行)货币结算的唯一方法。本行还向商业银行和一系列非银行提供中央银行存款账户(通常称为“准备金”)的访问权限,并能够清算这些账户之间的银行间债务,每天总计约5000亿英镑。自从我们于1996年启动实时总结算(RTGS)基础设施以来,结算银行已从全面和最终的即时结算中受益。现在RTGS已有20年历史了,本行正在为新一代RTGS制定蓝图。我们将在短期内就一揽子建议进行咨询,并且已经致力于进一步扩大央行服务给非银行支付商。

What do banknotes and RTGS have to do with developments in FinTech? We need to consider how we can harness FinTech to enable us to continue to deliver a safe and efficient payments system in a changing environment.

钞票和RTGS与金融科技的发展有什么关系?我们需要考虑如何利用金融科技,使我们能够在不断变化的环境中继续提供安全高效的支付系统。

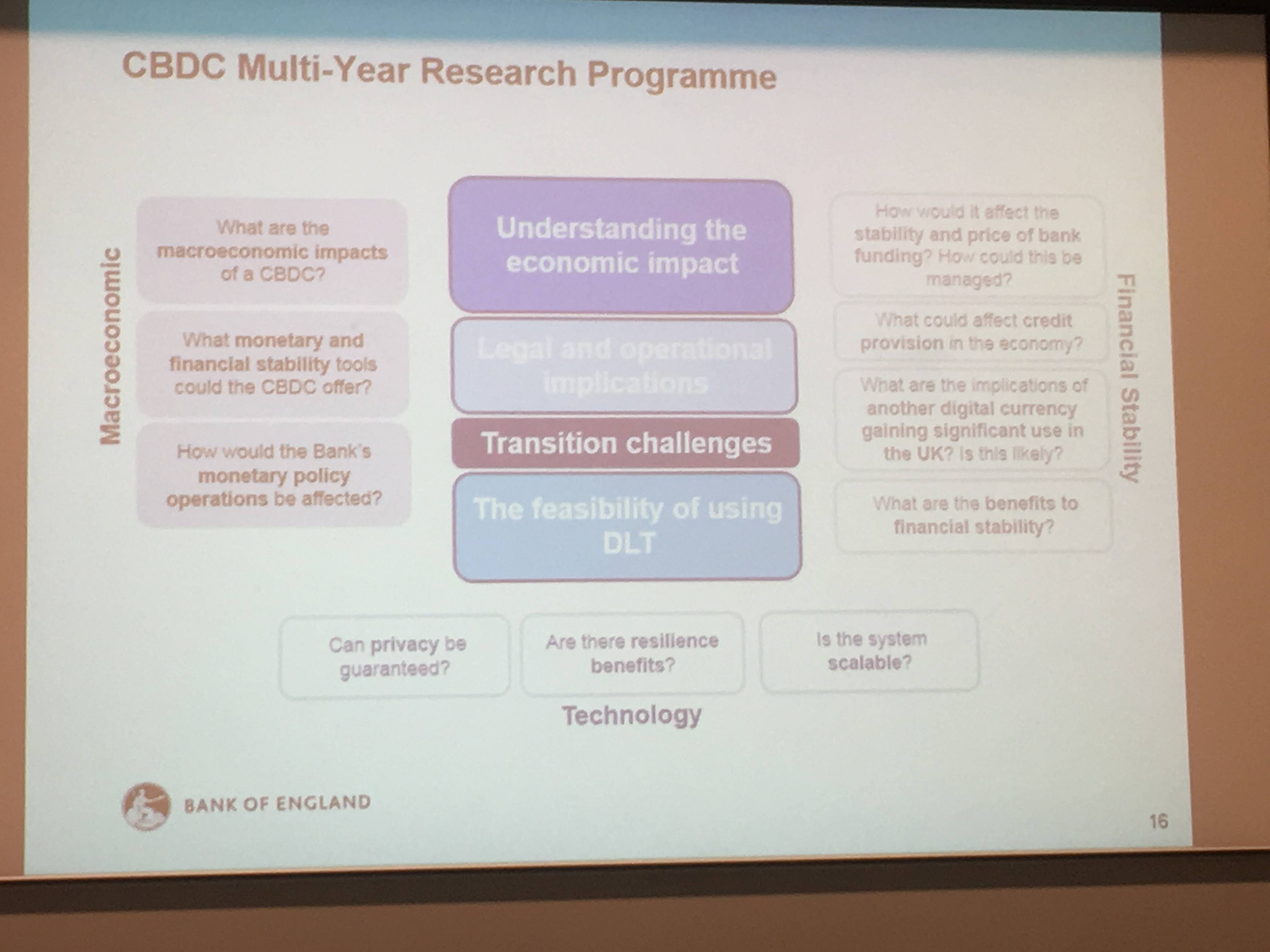

Separate to the current RTGS review, we are undertaking more fundamental long-term research on the wide range of questions posed by the potential of a central bank-issued digital currency (CBDC). Whether a CBDC would be feasible and whether it would benefit the economy and the financial sector, over the medium term are big issues, and the answers remain far from clear. We have embarked on a multi-year research programme so that any future decision is informed with a full understanding of the implications. To support this we have invited contributions to a set of research questions that we have recently published. on the opportunities and challenges that could arise from the introduction of CBDC. 与当前的RTGS审查不同,我们正在对由央行发行的数字法币(CBDC)的潜力所引起的广泛问题进行更基础的长期研究。从中期来看,CBDC是否可行以及是否会对经济和金融部门造福是个大问题,答案还很遥远。我们已着手进行一项为期多年的研究计划,以便将来的任何决定都能充分了解其含义。为了支持这一点,我们邀请引入最近发表的 “CBDC可能带来的机遇和挑战”等对一系列研究问题做支撑工作。

We need to understand the potential economic impact of extending access to central bank money.

A key part of the question relates to the potential breadth of access to CBDC and the functionality provided. At one end of the spectrum, CBDC could be quite limited and reserved for financial institutions: indeed RTGS today would be viewed as a limited-access CBDC, and the Bank’s proposals to widen access will extend its reach over the next few years. 我们需要了解数字法币扩大服务范围和需要提供的功能。在极端的情形下,数字法币只提供服务给金融机构。从某种意义上说,RTGS可以认为是限制的数字法币(译者:因为RTGS只开放给金融机构),本行提议的数字法币计划会在几年内扩大RTGS的服务范围。(译者:这里谈的就是批发型数字法币)

But the really big questions arise at the other end of the spectrum, where CBDC is available to everybody, allowing businesses and households to hold balances in central bank money and to pay each other in real time with full and final settlement, in an electronic format. While households are able to achieve this today directly with banknotes, they must use commercial banks or other financial institutions to make electronic payments. 但是最大的问题会发生在数字法币扩大服务到商家和家庭,让他们在央行开账户,做实时支付,并且立刻有最终的结算,而且全面电子化(译者:这里谈的就是零售数字法币和其作业方式)。现在家庭也可以有这样的服务,但是他们必须到商业银行或是金融机构才能得到这样的电子支付。

In the UK, those intra-bank payments are themselves fully backed by central bank money – either directly in the case of RTGS, or through so-called ‘prefunding’ in the retail payment schemes, eliminating settlement risk. The question is what could the benefits and costs be of removing this layer and of allowing businesses and consumers to transact directly and instantaneously in central bank money. 在英国,这些银行间支付完全由央行资金支持,或直接在RTGS中,或通过零售付款计划中的所谓“预付款”,消除了结算风险。问题是,去除这一层以及允许企业和消费者直接和即时地使用数字法币进行交易,其收益和成本会有什么。

There are numerous implications to be thought through. As Deputy Governor Ben Broadbent highlighted,providing wide access to CBDC could fundamentally change the structure of the financial system. For example, if a CBDC provided competition for commercial bank deposits, one outcome could be a reduction in deposit funding available to commercial banks, undermining their ability to provide credit to consumers. The risks that this could pose need to be fully explored and understood. 这里还是有很多因素需要考虑。正如副行长本·布罗德本特(Ben Broadbent)强调的那样,提供广泛的数字法币会从根本上改变金融体系的结构。例如,数字法币的竞争关系可能会使商业银行存款减少(译者:她没有提哪个单位会和商业银行竞争存款,其实就是英国央行,因为老百姓更愿意把钱换成数字英镑放在央行,没有风险,而且运转速度快,而不放在传统银行账户里面),那么结果可能是减少了商业银行可利用的存款资金,从而削弱了它们向消费者提供信贷的能力。我们需要充分探索和理解这可能带来的风险。

We also need to understand the technology options. Could, and should CBDC be delivered using DLT and is this technology the best way to achieve the necessary scalability and resilience? What are the implications on the privacy, and how could the rules for the operation of the distributed ledger be managed? DLT is still in its infancy, and there are numerous questions that need exploring. The Bank has already undertaken a proof of concept using this technology and we are looking for new opportunities through our FinTech accelerator 我们还需要了解技术选择。数字法币是否可以使用DLT技术?并且该技术是否是实现必要的可伸缩性和弹性的最佳方法?这对隐私有什么影响?如何管理分布式分类帐本的操作规则?DLT仍处于起步阶段,有许多问题需要探讨。本行已经进行了技术概念验证,我们正在通过金融科技加速器寻找新的机会。

These are significant questions and we are keen to receive external input and innovative ideas as we work through the possibilities. There is already a well-established relationship between the Bank and academia and we published our research questions in July in order to help stimulate further research in this area. I hope you all have a successful and inspiring conference. In the words of Sir Tim Berners-Lee - ‘we need diversity of thought in the world to face new challenges’. 这些都是很重要的问题,我们希望在可能的情况下努力寻求外部的投入和创新的想法。本行与学术界之间已经建立了良好的关系,我们在7月发表了研究问题,以帮助刺激这一领域的进一步研究。希望大家会议圆满成功。用蒂姆·伯纳斯·李爵士的话说:“我们需要世界各地的思想多样性来面对新的挑战”。

作者:

蔡维德

北航数字社会与区块链实验室主任,天德科技首席科学家,国家科技部重大项目负责人,国家大数据(贵州)综合试验区区块链互联网实验室主任, 天民(青岛)国际沙盒研究院院长, 赛迪(青岛)区块链研究院名誉院长,中国亚洲经济发展协会区块链产业专业委员会会长,北互金区块链专委会主任

王娟

西安交通大学应用经济学博士(后),美国佛罗里达大学系统工程博士后